social security tax limit

With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self. If your earned income is 160200 or greater in 2023 the maximum Social Security tax is 993240.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Only the social security tax has a wage base limit.

. Biden proposed raising payroll taxes on high earners to help fund Social Security while also making the programs benefits more generous for many. Keep in mind that this income limit applies only to the Social Security or Old-Age Survivors and Disability Insurance OASDI tax of 62. For comparison the contribution and benefit base in 2022 was 147000.

In the 2020 campaign Mr. As a result the maximum Social Security tax possible jumps from 9114 to 9932. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must.

The exception to this dollar limit is in the calendar year that you will. Several minority leaders in Congress indicate that holding the debt limit hostage to force program cuts in Social Security and Medicare is part of their 2023 playbook. As it only makes sense that the more you pour into the system in taxes the more your potential maximum benefits should be.

14 hours agoAmong other things the AWI determines the maximum earnings subject to Social Security payroll taxes at a 124 percent rate. 14 hours agoThere is a limit on the amount of your annual earnings that can be taxed by Social Security called the maximum taxable earnings. However if youre married and file separately youll likely have to pay taxes on your Social Security income.

There is a limit on the amount of your annual earnings that can be taxed by Social Security called the maximum taxable earnings. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is.

This so-called tax max increased from 147000. Everyone pays the same rate regardless of how much they earn until they hit the ceiling. The Social Security taxable maximum is 142800 in 2021.

For 2022 the Social Security earnings limit is 19560. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021. The OASDI tax rate for wages in 2022 is 62 each for employers and employees.

The 2022 limit for joint filers is 32000. As of 2021 a single rate of 124 is. Your taxes could jump.

Social Security functions much like a flat tax. Between 25000 and 34000 you may have to pay income tax on. For earnings in 2022.

What Is the Social Security Tax Limit. That means an employee earning 147000 or more would pay a maximum of 9114 into. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax.

Workers pay a 62. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. 9 rows This amount is known as the maximum taxable earnings and changes each year.

So for people making over 160200 in 2023 they will be paying 818 more in Social. The wage base limit is the maximum wage thats subject to the tax for that year. The 2021 tax limit is 5100 more than the 2020 taxable maximum.

That limit will rise to 160200 in 2023 from. Increased Maximum Social Security Benefit. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages.

Wage Base Limits. Fifty percent of a taxpayers benefits may be taxable if they are. That limit will rise to 160200 in 2023 from.

What is the income limit for paying taxes on Social Security. For every 2 you exceed that limit 1 will be withheld in benefits.

:max_bytes(150000):strip_icc()/social_security_card-157422696-5c607e6046e0fb00014422ac.jpg)

Social Security Maximum Taxable Earnings 2022

What Is The Maximum Social Security Tax For 2015 The Motley Fool

What S The Social Security Payroll Tax Limit For 2022

Federal Insurance Contributions Act Wikipedia

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About Fica Social Security And Medicare Taxes

What Is The Social Security Wage Base 2022 Taxable Limit

The Evolution Of Social Security S Taxable Maximum

The Evolution Of Social Security S Taxable Maximum

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

81 Years Of Social Security S Maximum Taxable Earnings In 1 Chart The Motley Fool

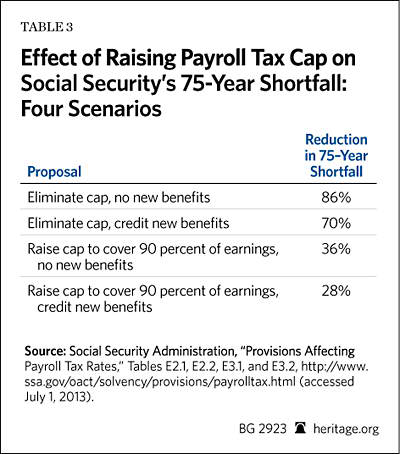

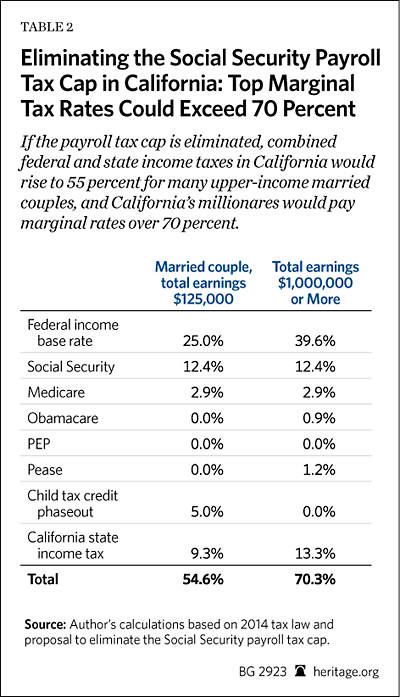

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation

Social Security Payroll Tax Cap Change Could Boost Struggling Benefits Program Don T Mess With Taxes

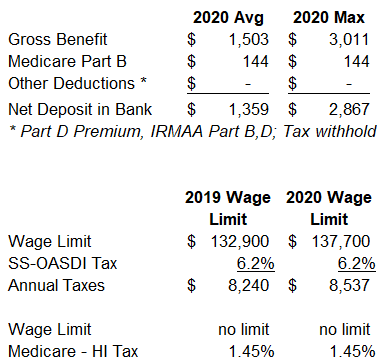

2020 Social Security Inflation 1 6 For Benefits 3 6 For Wage Limit On Fica Pebble Valley Wealth Management

The Social Security Tax Limit For 2022 And How It Works Explained The Us Sun

Maximum Social Security Tax In 2021

Maximum Taxable Income Amount For Social Security Tax Fica

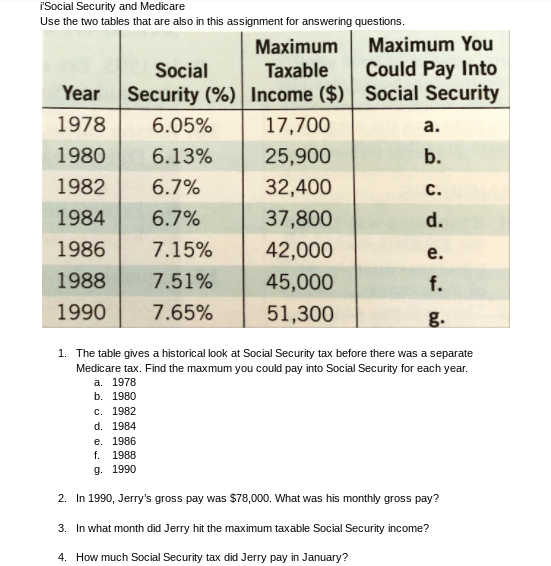

Solved I Social Security And Medicare Use The Two Tables Chegg Com

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation